Countdown240Days

Research Center for International Inspection and Quarantine Standards and Technical Regulations of GACC

China General Chamber of Commerce

Yiwu Brand Light Exhibition Co., Ltd.

Research Center for International Inspection and Quarantine Standards and Technical Regulations of GACC

Global Industrial and Commercial LED Lighting Market is estimated to be valued at US$ 187.1 Bn by 2030.The commercial lighting refers to the lighting fixtures used for commercial spaces such as stores, offices, hospitals, institutions, government buildings, and other places that are not residential or manufacturing. Commercial lighting is rapidly adopting LED lighting fixtures since they provide higher cost-efficiency, energy-efficiency, and a variety of options. LED lighting delivers a high level of brightness, is reliable, and lasts longer than conventional lighting fixtures. LED lights are constructed using semiconductor components and emit little radiated heat as compared to other competing products.

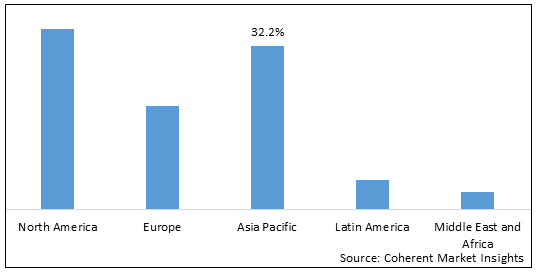

Global Industrial and Commercial LED Lighting Market: Regional Insights

Due to increased government investment and a ban on the production and import of incandescent lamps, the industrial and commercial LED lighting market in Europe is anticipated to account for a significant share. Due to high construction rates, the replacement of existing outdoor infrastructure, and government funding for high-efficiency building lighting, Asia Pacific is also anticipated to be one of the leading contributors. In order to implement standardized high-quality products and solutions, the Chinese government has offered substantial incentives to switch from conventional streetlights to LEDs.

The government also announced in 2012 that it would prohibit the import and sale of incandescent bulbs with 100 watts or more, which is anticipated to further increase demand. Moreover, expanding interest in framework including streets, retail plazas, and quick urbanization in nations like Mexico, India, and Taiwan has made energy-proficient advances. Other nations, including Russia, Germany, Denmark, the United Kingdom, and Denmark, are concentrating on implementing effective strategies to enhance quality and reduce overall costs.

Figure 1: Global Industrial and Commercial LED Lighting Market: Share (%), By Region, 2022

Global Industrial and Commercial LED Lighting Market - Impact of Coronavirus (Covid-19) Pandemic

The market for industrial and commercial LED lighting has been impacted by COVID-19. Light-emitting diode (LED) lighting technology's sales and production were hampered by low investment costs and a lack of employees. However, new safety measures were used to develop the practices by market leaders and the government. Industrial and commercial light-emitting diode (LED) lighting sales increased as technology improved to attract the right customers. In the post-pandemic scenario, it is anticipated that the increase in device sales will further propel market expansion.

Global Industrial and Commercial LED Lighting Market - Drivers:

High efficiency and durability of LED light are expected to drive growth

High efficiency and durability of LED lights are expected to drive growth of the global industrial and commercial LED lighting market during the forecast period. LED is considered as a feasible alternative to conventional lighting due to its longer life span and higher energy-saving potential. LED lighting products are increasingly replacing conventional lighting products, owing to various benefits such as greater energy efficiency, high eco-friendly properties, small size, and lower heat output. LED lighting is an advanced and futuristic source of lighting as it reduces power consumption by up to 80% and generates about 90% less heat than incandescent bulbs. The life span of LED bulbs is about 10 times higher than that of compact fluorescent lamps and much higher than incandescent lamps. According to DOE, the widespread use of LEDs could save 348 TWh (compared to no LED use) of electricity which is equivalent to annual electricity output of 44 large electric power plants generating 1,000 MW each and result in a total saving of US$ 30 billion at today’s electricity prices.

Government regulations are expected to boost the market

Government regulations on incandescent lamps are expected to boost the global industrial and commercial LED lighting market growth over the forecast period. Incandescent lamps consume more energy than LED lamps and thus, several governments have introduced stringent regulatory restrictions on their use. As a matter of fact, some countries have essentially banned the use of incandescent lamps. For instance, on February 20, Legrand acquired Focal Point, a privately held manufacturer of architectural lighting products with its headquarters in Chicago, Legrand is now a full-service provider of architectural lighting solutions thanks to this acquisition, the fifth in its Lighting Sector.

Industrial and Commercial LED Lighting Market Report Coverage

| Report Coverage | Details | ||

|---|---|---|---|

| base Year: | 2022 | Market Size in 2022: | US$ 42.8 Bn |

| Historical Data for: | 2017 to 2021 | Forecast Period: | 2023 to 2030 |

| Forecast Period 2023 to 2030 CAGR: | 20.3 % | 2030 Value Projection: | US$ 187.1 Bn |

| Geographies covered: |

| ||

| Segments covered: |

| ||

| Companies covered: | Toshiba Corporation, Digital Lumens, Inc., GE Lighting Solutions, Koninklijke Philips Electronics N.V.3, Osram Licht AG, Cooper Industries plc, Cree, Inc., and Dialight plc. | ||

| Growth Drivers: |

| ||

| Restraints & Challenges: |

| ||

Global Industrial and Commercial LED Lighting Market - Opportunities:

LED technology to dominate the publication trend compared to fluorescent technology

By analyzing patent filing trends over the last decade from 2000 to 2009, it is evident that LED technology filings dominated the publication trends by a wide margin as compared to fluorescent technology. in March 2020, With the recently granted D4i certification, Signify upgraded its portfolio of compact Philips Xitanium Sensor Ready Xtreme LED drivers for outdoor applications. This certification program aims to standardize the market, encourage greater use of IoT connectivity in lighting, and support smart city or building projects.

High efficiency and durability are to drive demand for LED

There is huge scope for LED lighting in the global lighting market. High efficiency and durability are driving demand for LED lighting across the globe. Currently, the penetration of LED lighting in the global lighting market is about 7% with incandescent and fluorescent lighting accounting for the majority of the market share. However, the market is witnessing higher adoption of LED lighting due to various benefits. Hence, the LED lighting market is expected to grow at a faster rate in the next few years. Design flexibility, controllability, and the ability to change the color temperature of LED lights enables intelligent lighting systems.

Research and development activities among market players

Key market players are focusing on research and development activities in order to expand their product portfolio. For instance, In February 2020, Toshiba, a Japan based multinational company launched LED Lighting products in North America.

Global Industrial and Commercial LED Lighting Market was valued at US$ 42.8 Bn in 2022 and is forecast to reach a value of US$ 187.1 Bn by 2030, exhibiting CAGR of 20.3% between 2023 and 2030.

Global Industrial and Commercial LED Lighting Market - Trends:

Companies are focused on research and development

Major companies are focused on research and development activities, in order to gain a competitive edge in the market. For instance, In July 2020, GE Current and Pointr (UK) formed a partnership to enable location-based services in large buildings like warehouses, offices, retail establishments, and distribution centers. Current savvy lighting joined with Pointr's area based administrations convey high-esteem applications to retailers, stockrooms, and modern premises, giving the capacity to comprehend the exact area of workers and guests utilizing any Android or iOS gadgets, for example, cell phones or Honeywell gadgets.

Government authorities are using LED lights for public infrastructure.

Government authorities are significantly investing in public infrastructures such as railway stations and airports wherein LED lights are being used. Since these lighting fixtures last longer than conventional lights and are energy efficiency, government authorities are more inclined towards LED lighting.

Global Industrial and Commercial LED Lighting Market - Restraints:

Significant dominance of fluorescent lamps is expected to restrain growth of the global industrial and commercial LED lighting market during the forecast period. Despite its popularity in developed countries, LED technology is still in the nascent stage and has low penetration in terms of technology and dominance as compared to other technologies in lighting. According to Coherent Market Insights’ analysis, in 2012, incandescent bulbs accounted for a market share of 58% in the lighting market, followed by fluorescent lamps with 25%. LED has a market penetration of around less than 10% due to its high cost.

High initial cost is expected to hinder the global industrial and commercial LED lighting market growth over the forecast period. Initial installation and adoption cost of LED is a major restraining factor in the market. A compact fluorescent lamp (CFL) has a shorter life span than LED light. If a CFL is replaced to achieve a lifespan equivalent to that of an LED light, only US$ 2.5 would require as compared to US$ 45, which is the initial purchase price of the LED light.

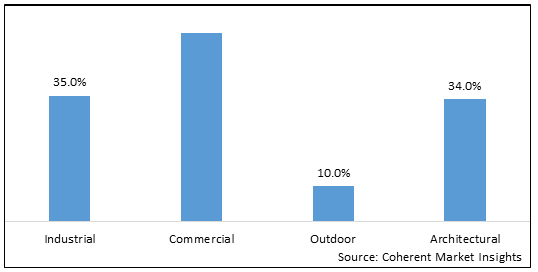

Figure 2: Global Industrial and Commercial LED Lighting Market Share (%), By Segment, 2022

Global Industrial and Commercial LED Lighting Market - Segmentation:

Global Human Machine Interface market report is segmented by End User.

based on End User, the market is segmented into Industrial, Commercial, Outdoor, and Architectural

Global Industrial and Commercial LED Lighting Market: Key Developments

In June 2021, Eaton Corporation, launched of the PowerXL DM1 micro variable frequency drive, designed for commercial, industrial and original equipment manufacturer (OEM) customers

In June 2021, Yaskawa Electric Corporation announced HV600 family of drives employs the latest advancements in variable speed control for HVAC applications

Global Industrial and Commercial LED Lighting Market: Key Companies Insights

Global Industrial and Commercial LED Lighting Market is highly competitive, owing to rising launch of new technologies due to ongoing R&D and efforts by value chain participants. Moreover, key players are adopting various business growth strategies in order to expand their presence on regional as well as global basis. Some of the key players in the Global Human Machine Interface market are Toshiba Corporation, Digital Lumens, Inc., GE Lighting Solutions, Koninklijke Philips Electronics N.V.3, Osram Licht AG, Cooper Industries plc, Cree, Inc., and Dialight plc.